Usda home loan how much can i borrow

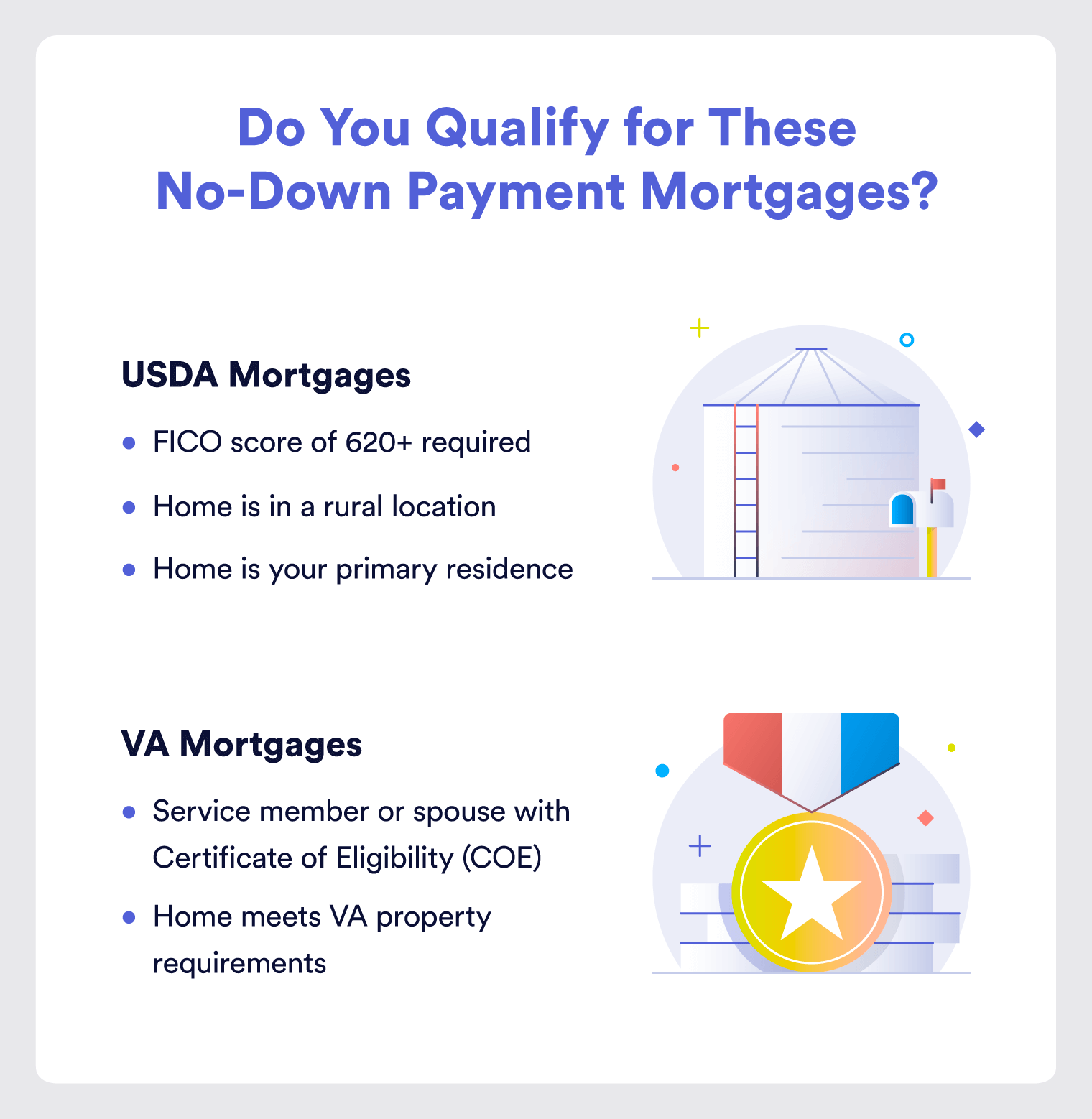

Find a Home in a USDA-Eligible Area. 620 for manual underwriting but processing is longer.

Pin On Quick Saves

You might put 10 down borrow 80 with a traditional mortgage and borrow the remaining 10 with a piggyback home equity loan.

. The maximum loan amount an applicant qualifies for. How much house can I afford with a USDA loan. The usual rule of thumb is that you can afford a mortgage two to 25 times your income.

USDA Loan Specialist Our network of loan officers specialize in USDA loans. Working with a lender that specializes in this rural home program can make a big difference for homebuyers. How Much Mortgage Can I Afford if My Income Is 60000.

In the US the Federal government created several programs or government sponsored. Apply for a Smaller Home Loan. Heres how it works.

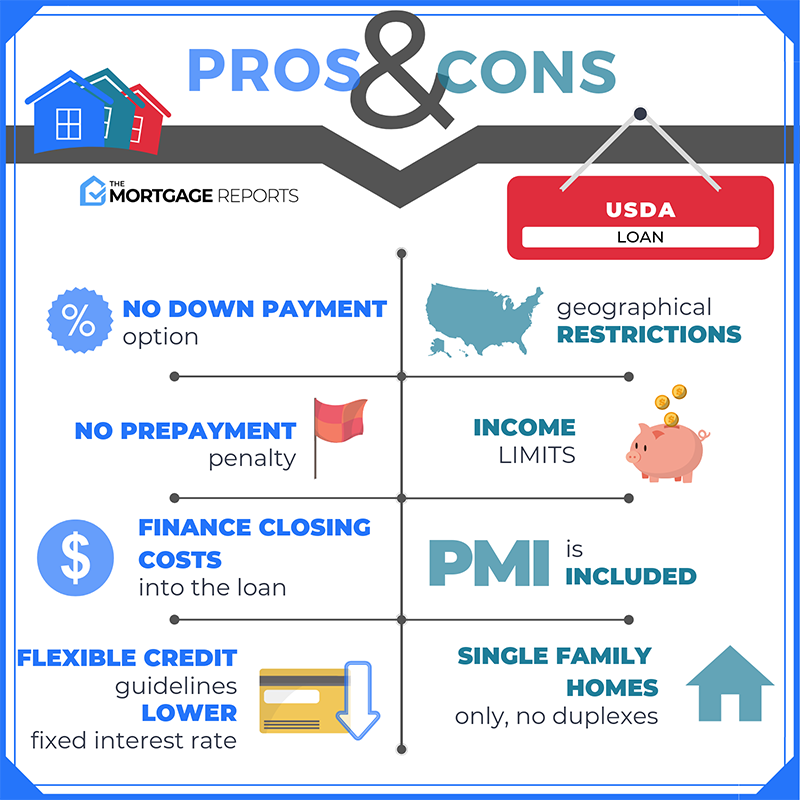

Qualifying can be easier if you can buy a home farther away from the city. Using a USDA loan buyers can finance 100 of a home purchase price while getting access to better-than-average mortgage rates. How much additional cash do you wish to borrow.

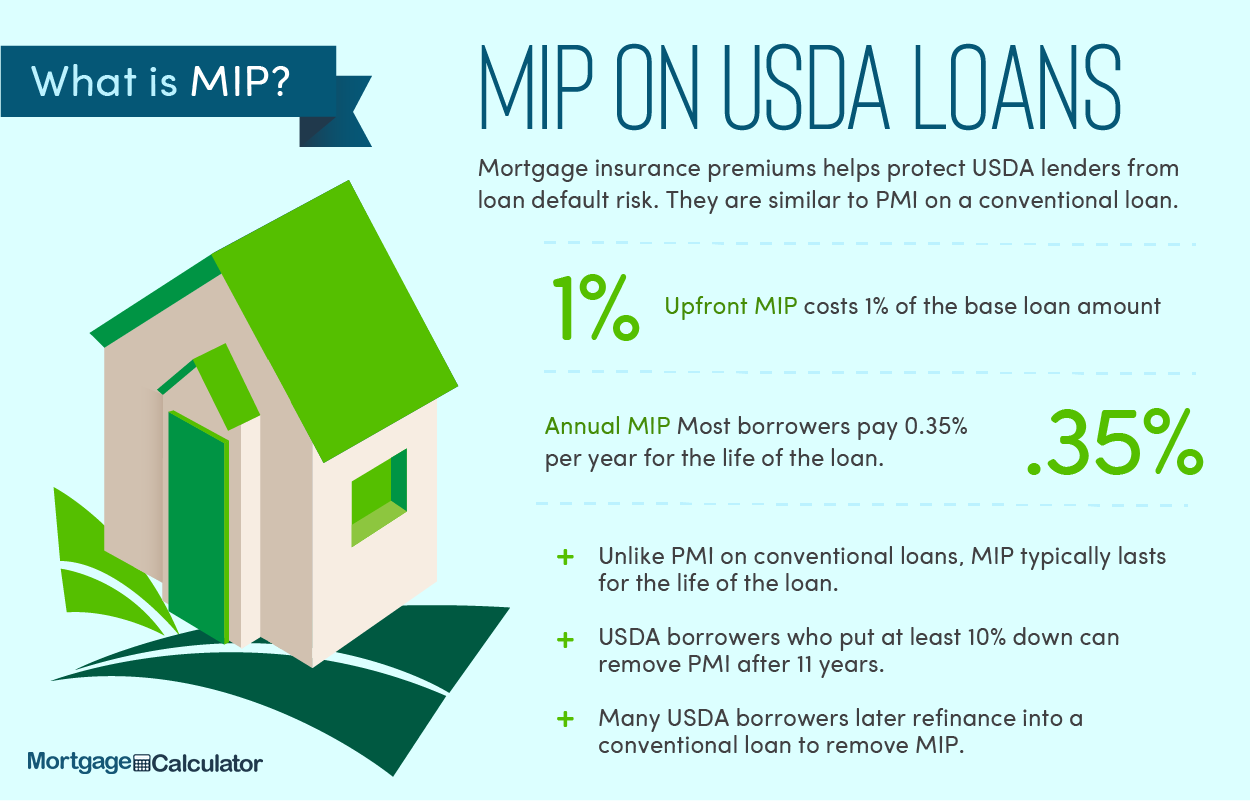

A USDA construction loan is a mortgage that is guaranteed by the US. An FHA loan can An FHA loan can also take 30 to 45 days to close depending on the application process and how long underwriting takes. Interest rate when modified by payment assistance can be as low as 1.

Department of Agriculture USDA. The program is designed to make housing accessible and affordable in rural areas. 31000 23000 subsidized 7000 unsubsidized Independent.

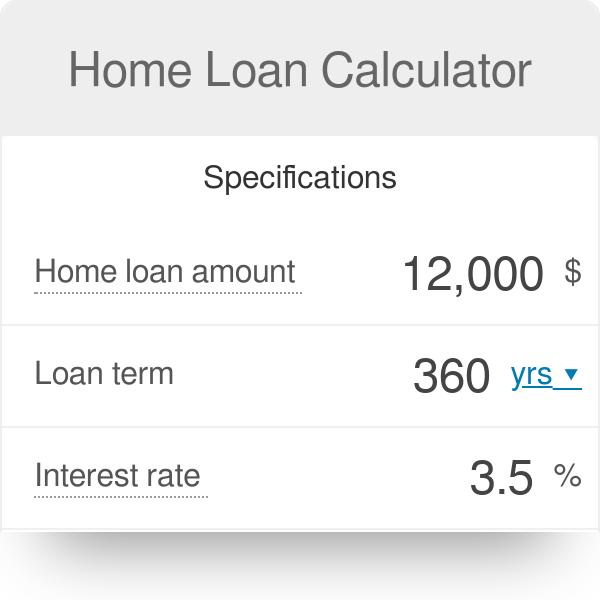

This means you can actually finance 102 of the value of the house and avoid paying this fee upfront. Funds can be used to build repair renovate or relocate a home or to purchase and prepare sites including providing water and waste treatment equipment. Effective September 1 2022 the current interest rate for Single Family Housing Direct home loans is 350 for low-income and very low-income borrowers.

USDA loans for qualifying rural areas are much more flexible than regular loans. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. The amount you can borrow is limited by your income and your.

Most mortgages have a loan term of 30 years. Now its time to find a home in a USDA-eligible area and make an offer. How can funds be used.

The first step to getting a USDA loan is finding a USDA-approved lender. Hundreds of lenders make USDA loans but some might only make a few of them every year. They dont require a down payment and can include the mortgage insurance fee in the loan.

Connect with a USDA Loan Specialist. Expect a USDA loan to close in 30 45 days. Total subsidized and unsubsidized loan limits over the course of your entire education include.

Since 2010 20-year and 15-year. Your preapproval letter shows sellers and agents youre a lender-verified USDA buyer who can close. The drawback here is the piggyback second loan often comes with a higher interest rate that may also be adjustable meaning it could go even higher during the life of the loan.

How much can I borrow. The time it takes for underwriting depends on where youre planning to purchase and how much backlog the USDA agency in that area has. 1 Find a Lender and Prequalify For a USDA Loan.

Sometimes known as loan term the length of the loan is the number of years until your home loan is paid in full. And the property must pass a USDA appraisal before final loan approval can be issued. This provides a rough estimate of how much you can borrow for a loan.

Like a traditional USDA loan home buyers borrow from a traditional lender and the USDA backs the loanThe difference between the two is that while a typical USDA loan allows a. The application and. Fairway - Online.

Refinancing for an existing home in need of repairs totaling 5000 or more to correct major deficiencies and make the dwelling decent safe and sanitary. Alterra - Fully online application mobile loan tracking borrow with nontraditional credit. The United States Department of Agriculture will guarantee your home loan but the entire process is handled through a local bank or lender.

USDA Home Specialist. Its OK to estimate 0 - 50000. They will make the loan process smooth and seamless.

The USDA home loan process isnt much different than a traditional mortgage program. At 60000 thats a 120000 to 150000 mortgage. Youve been preapproved for a USDA home loan.

Refinancing for a site without a dwelling if the debt was for the sole purpose of purchasing the site the applicant is unable to pay the debt and the applicant is otherwise unable to. Fixed interest rate based on current market rates at loan approval or loan closing whichever is lower. Loan funds can be used to help low-income people or households buy homes in rural areas.

Its a good indicator of whether you satisfy minimum requirements to qualify for.

Home Loan Calculator House Loan Calculator

How Much Can I Borrow First Home Buyer Shop 57 Off Www Ingeniovirtual Com

Usda Guaranteed Loan In 2022 Guaranteed Loan Usda Loan Money Management

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

How To Finance Building Your Homestead Homestead Hustle How To Buy Land Construction Loans Homesteading

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

100 Financing Rural Development Loan Development Rural Next At Home

What Credit Score Is Needed To Buy A House Credit Score Credit Score Repair Improve Credit Score

Usda Rural Home Loans Explained Nextadvisor With Time

Pin By Anseth Richards On Farm Loans Farm Loan The Borrowers Borrow Money

What Type Of Mortgage Should You Get Refinance Mortgage Mortgage Loans Refinancing Mortgage

Bp Federal Credit Union Mortgage Rates Review Good Financial Cents Mortgage Rates Fha Loans Mortgage

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

What Is 100 Mortgage Financing And How To Get It

Pin On Mortgage Broker

9 Mistakes To Avoid After Mortgage Preapproval Preapproved Mortgage Pay Off Mortgage Early Refinance Mortgage

Steps To Buying A House Buying First Home Home Buying Tips Home Buying